$0 deductible health insurance good or bad

Deductibles and co-pays also tend to range anywhere from 3000 to nearly 7000 which is much higher than Original Medicare. There are also major medical plans with an upfront cost of 0 called no-deductible plans.

What Is Coinsurance 9 Mysteries Of Health Insurance Solved Black Women S Health Imperative

Compare the Best Coverage in Minutes.

. Depending on the plan this will likely mean lower out of pocket costs for services. The only reason that 0 copay would be better is if you have met your deductible and then have a large expense say 10000 hospital stay. Ad Get Blue Cross Health Insurance Plans.

Illinois Bright Health Bronze 0 Medical Deductible Ambetter Essential Care 0 Medical Deductible Ambetter Balanced Care 28. Narrow down your choices to just a few plans perhaps one low-deductible and one high-deductible health plan. If you have a covered claim for 1500 in repairs your insurer would reimburse you the full 1500.

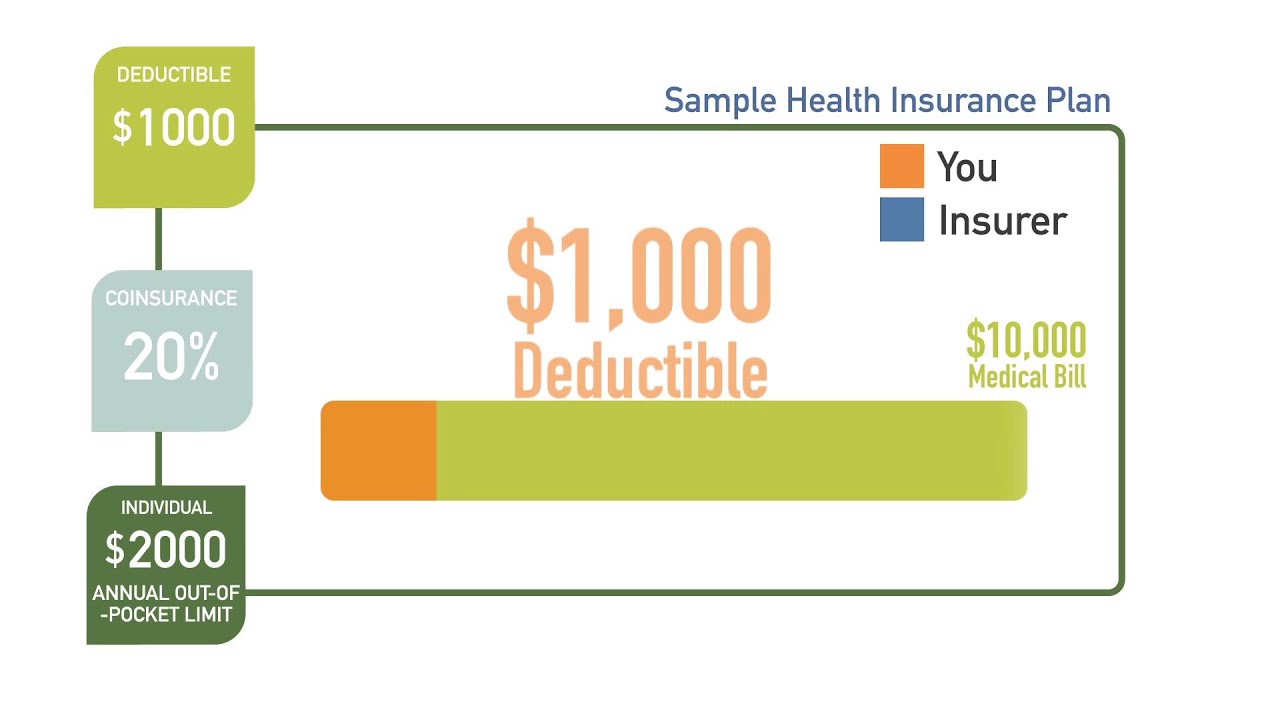

An HDHP is a plan with at least a 1400 deductible for an individual or a 2800 deductible for a family in 2022. A prominent study looked at the impact of High Deductible Health Plans HDHPs over a six-year period 1. For example if your deductible is 1500 you will pay the first 1500 in medical bills out of your own pocket.

Ad Texas Health Insurance Plans. Ad Compare Plans Coverage Costs in Minutes. For example say you opted for collision coverage with no deductible.

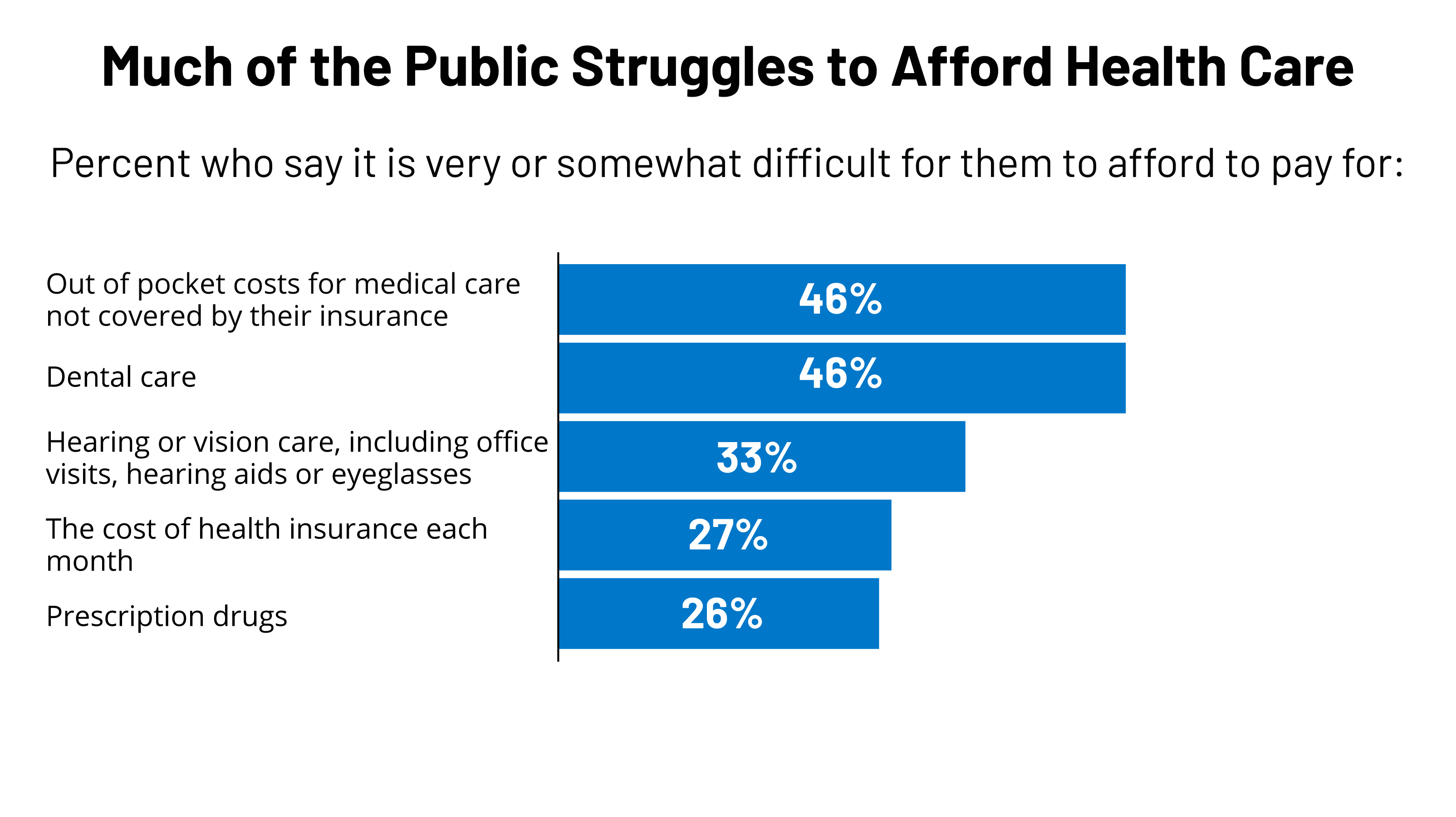

An insurance plan with no deductible may appeal to consumers who frequently visit. Zero-deductible plans typically come with higher premiums whereas high-deductible plans come with lower monthly premiums. Types of Health Insurance Plans.

VA healthcare and limited medical insurance plans do not have deductibles. After all health insurance may make health care affordable - but it cant be 100 free except in a perfect world. List of the Cons of a High Deductible Health Plan.

Employees often feel that a high deductible health plan forces them to spend more money at first because they must meet specific obligations before the full benefits begin to kick-in for them. Before you aged into Medicare you were probably used to seeing health insurance plans with monthly premiums of over 500 and in. A 35000 employee group went from a Rolls Royce plan with a 0 deductible 0 out-of-pocket to a HDHP with a 1000 to 1500 health savings account contribution and a 3000 deductible.

Obviously paying 0 0 is better than paying 3k - 5k 30-50. Missing Open Enrollment may force you to view. Not perfect but a start.

These plans tend to have more comprehensive coverage but may cost a little more. Individuals and Families. Having health insurance can lower your costs even when you have to pay out of pocket to meet your deductible.

While choices like this have many gaps and limitations if all other alternatives have been exhausted the no-deductible health insurance plan should be considered. Instantly Find the Best Price. Yes a zero-deductible plan means that you do not have to meet a minimum balance before the health insurance company will contribute to your health care expenses.

People without insurance pay on average twice as much for care. Some families avoid seeking medical treatment because of the deductible cost. Here are 6 important things to know about deductibles.

Health Insurance With A Zero-Dollar Deductible Anytime you increase the benefit in one area of a health plan you can expect other areas to compensate to a degree. A 0 deductible means that youll start paying after deductible rates right away. MENINGITIS CSF LEAK SO BAD I ALMOST DIED.

But from your question you dont even meet the lower deductible of 3000 in a typical year. Having zero-deductible car insurance means you selected coverage options that dont require you to pay any amount up front toward a covered claim. A quick search on Healthcaregov reveals a family of your size in Texas could pay.

The second number refers to the maximum deductible for all members of the plan. Deductibles are cumulative over the course of a calendar year each time you pay a small bill it counts towards your deductible. The amount you pay for health care before your insurance kicks in.

Get Quotes in Two Simple Steps. Insurance companies negotiate their rates with providers and youll pay that discounted rate. A 5000 deductible plan to someone that has a 10000 deductible is good For me it would be considered bad My employers have fully paid my premiums for me and my deductibles have been anywhere between 250-500 so I consider a plan closer to that as good At the same time I talk to friends that have premiums fully paid for and 0 deductibles and my plan is bad to.

Answer 1 of 8. Put simply having a high deductible plan or a zero deductible plan isnt bad in and of itself. If it has a coinsurance you get a percentage covered by the company and then you owe the other percentage ex.

NOONE CARES ABOUT PAIN PATIENTS AND YOU MAKE A COMMERCIAL SAYING THEY ONLY. A premium is what you pay every month for your plan. It means youre likely paying a whole lot of money in premiums in order to have a false peace of mind ifwhen you go to the doctor.

A health plan deductible is the amount you pay out of pocket before your insurance covers any cost. The good news is that the insurance company begins paying your claims right away. No not with your assumptions.

What works for one healthcare consumer may be inadequate for another and vice versa. A deductible is the amount youre responsible for paying for health care before your insurance takes over. Some HDHPs come with HSAs attached.

Spend declined 12 2. 0 deductible just means there is no deductible to satisfy before benefits kick in. Here is a comparison of the three health insurance options currently being offered by my wifes.

0 deductible for. The average health consumer purchasing insurance on the Affordable Care Act marketplace stands to save 1462 Rx deductibles and 3482 on other high value medical services. If its a fixed indemnity you get a fixed benefit towards every claim.

It just depends on the specifics of your health and finances. Instead of having to meet that deductible youll simply move past it. When you see a health insurance plan with a 500.

If your deductible says 5001500 that means each individual on the plan has a maximum 500 deductible. The bad news is that you pay higher monthly premiums and still share costs through copays and coinsurance. Start Your Free Online Quote.

89 Health Insurance From Blue Cross.

How A Deductible Works For Health Insurance

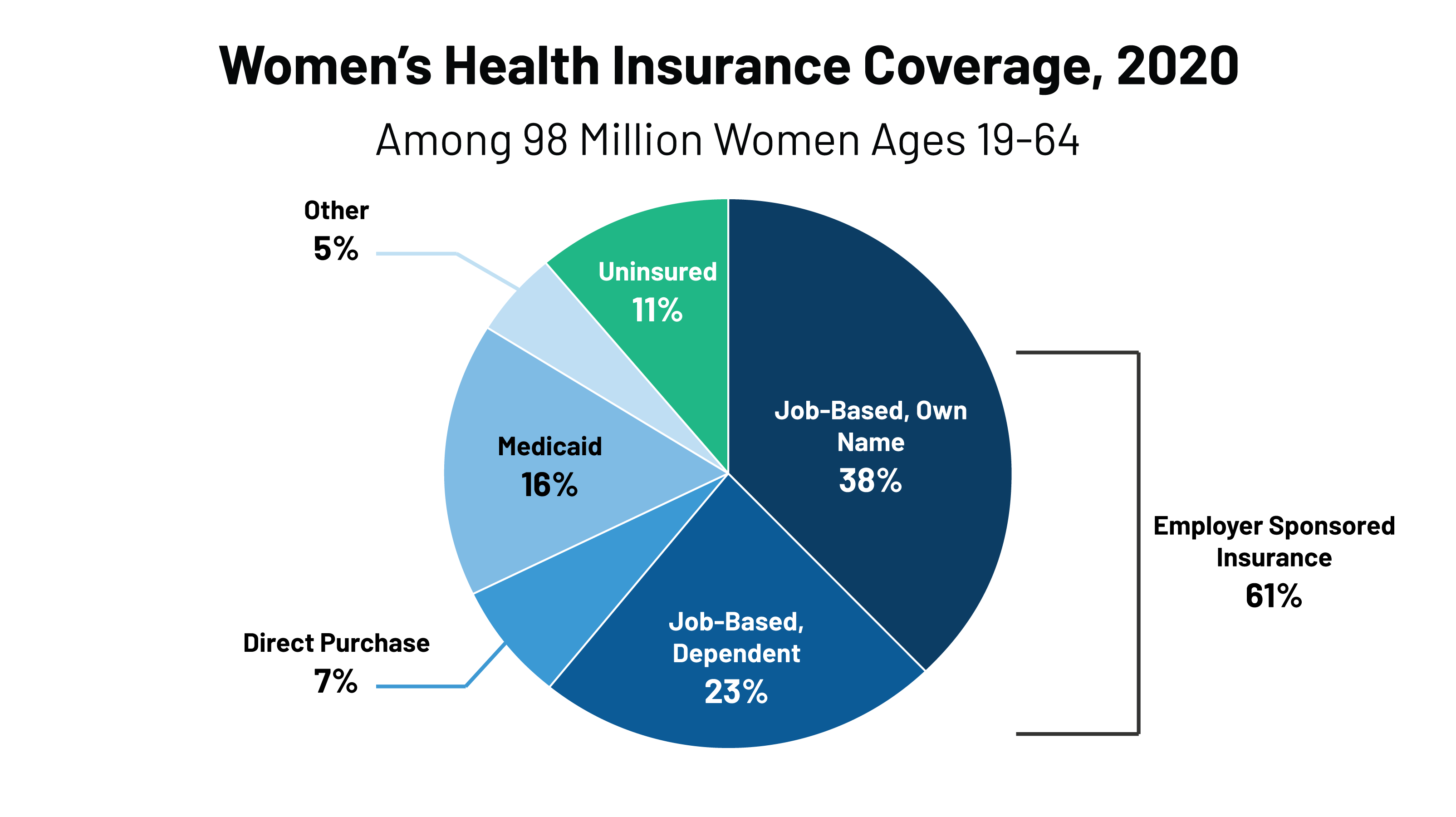

Women S Health Insurance Coverage Kff

Health Insurance Basics How To Understand Coverage

Health Insurance Costs Crushing Many People Who Don T Get Federal Subsidies Kaiser Health News

Tips For Getting Insurance That S Better Or Less Expensive Or Both Shots Health News Npr

Pros And Cons Of Low Deductible Health Insurance Plans Healthination

How A Deductible Works For Health Insurance

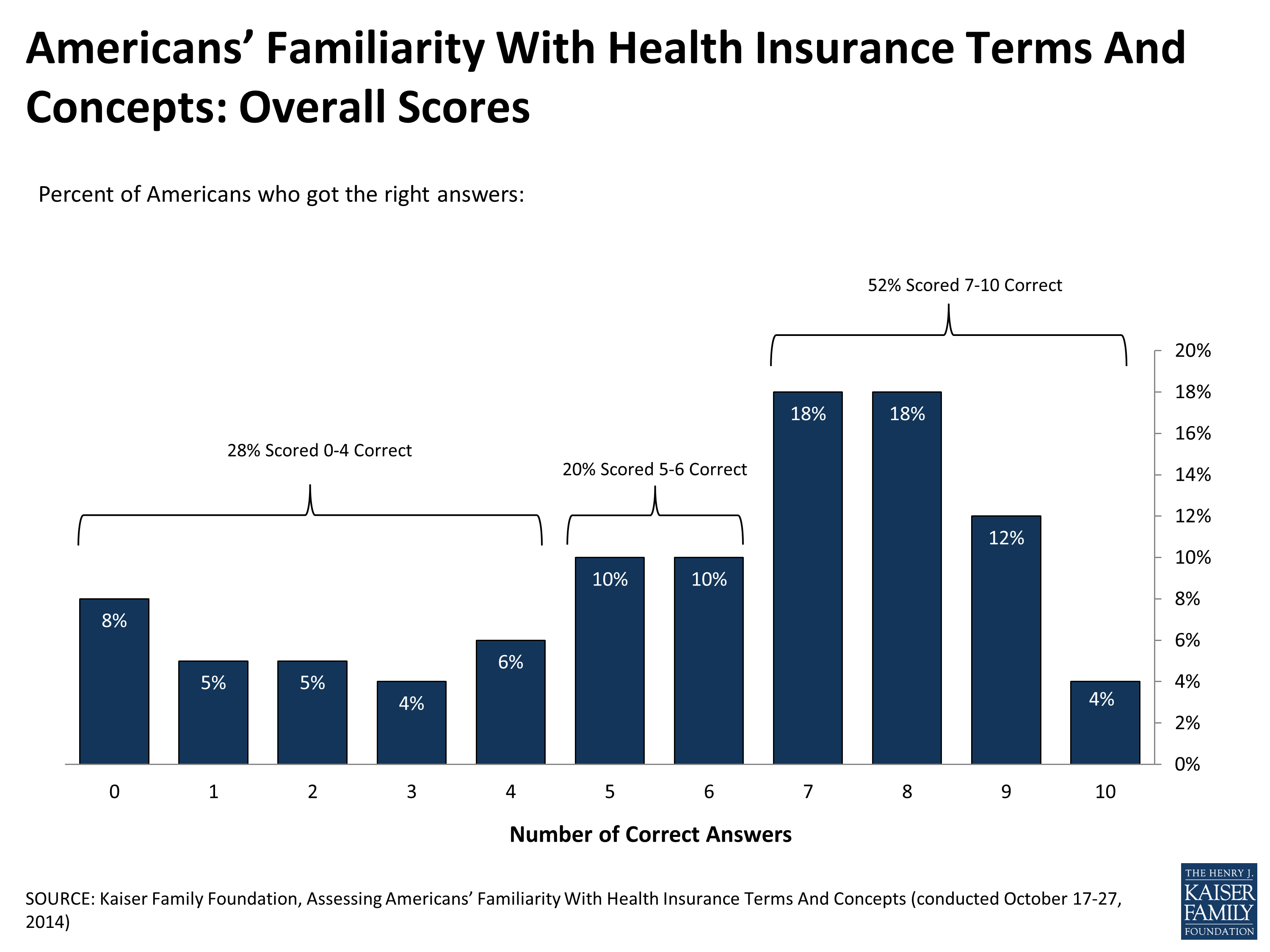

Assessing Americans Familiarity With Health Insurance Terms And Concepts Findings Kff

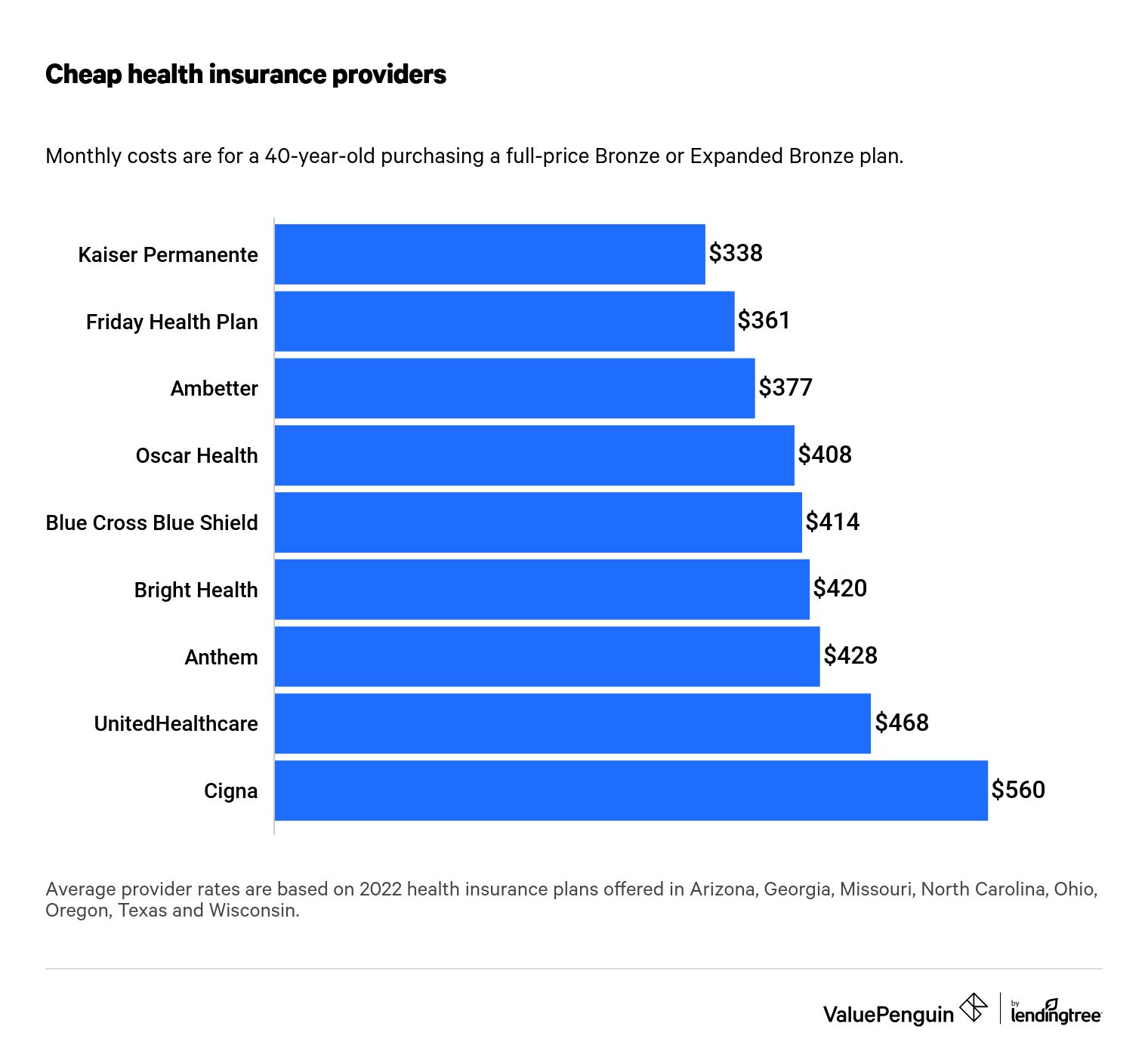

Cheap Health Insurance Find Low Cost 2022 Plans Valuepenguin

High Deductible Health Plan Hdhp Pros And Cons

High Deductible Health Plans Pros Cons And Faqs Goodrx

Understanding Key Health Insurance Terms Advice Blog

Californians Without Health Insurance Will Pay A Penalty Or Not California Healthline

Make The Right Choosing In Life Homeowners Insurance Insurance Quotes Health Insurance Plans

Health Insurance It S Now About The Price Of A New Car Each Year Patrick Malone Associates P C Dc Injury Lawyers Jdsupra

:max_bytes(150000):strip_icc()/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)

Life Vs Health Insurance Choosing What To Buy

25 Important Pros Cons Of Health Insurance E C